Strong Support: Trust Foundations You Can Count On

Strong Support: Trust Foundations You Can Count On

Blog Article

Safeguarding Your Properties: Count On Foundation Knowledge within your reaches

In today's intricate economic landscape, making certain the safety and development of your possessions is critical. Trust fund structures act as a keystone for safeguarding your wide range and heritage, providing an organized approach to property security. Knowledge in this realm can supply very useful guidance on browsing lawful intricacies, maximizing tax obligation performances, and creating a durable economic plan tailored to your unique demands. By using this specialized knowledge, individuals can not just safeguard their assets successfully yet likewise lay a strong structure for long-lasting wide range preservation. As we explore the ins and outs of trust structure knowledge, a globe of possibilities unfolds for fortifying your monetary future.

Value of Depend On Structures

Trust foundations play a crucial duty in establishing integrity and promoting strong partnerships in various professional settings. Depend on structures offer as the keystone for moral decision-making and clear interaction within organizations.

Benefits of Professional Assistance

Building on the foundation of count on in expert connections, seeking expert assistance offers indispensable benefits for individuals and organizations alike. Specialist advice gives a riches of understanding and experience that can assist navigate complex economic, lawful, or calculated obstacles easily. By leveraging the competence of experts in various areas, people and organizations can make informed choices that line up with their goals and aspirations.

One substantial advantage of expert guidance is the capacity to gain access to specialized knowledge that might not be easily available otherwise. Specialists can provide insights and viewpoints that can result in innovative remedies and chances for development. Furthermore, working with specialists can assist mitigate dangers and uncertainties by giving a clear roadmap for success.

Additionally, expert support can save time and sources by streamlining procedures and avoiding pricey mistakes. trust foundations. Specialists can offer tailored guidance customized to specific requirements, ensuring that every choice is well-informed and calculated. On the whole, the benefits of professional guidance are diverse, making it a beneficial asset in securing and making the most of properties for the long-term

Ensuring Financial Safety And Security

Ensuring economic protection includes a diverse method that encompasses various facets of wide range administration. By spreading investments throughout different asset courses, such as supplies, bonds, genuine estate, and commodities, the threat of considerable monetary loss can be mitigated.

In addition, preserving an emergency fund is important to safeguard versus unexpected expenditures or revenue interruptions. Experts advise setting apart three to six months' well worth of living expenses in a fluid, quickly accessible account. This fund functions as an economic safety web, offering satisfaction throughout rough times.

On a regular basis examining and changing economic strategies in action to altering scenarios is likewise extremely important. Life events, market variations, and legislative adjustments can impact monetary stability, highlighting the importance of continuous analysis and adaptation in the quest of long-term monetary protection - trust foundations. By executing these methods thoughtfully and regularly, people can strengthen their financial ground and job towards a much more secure future

Protecting Your Properties Effectively

With a solid structure in area for financial safety and security via diversity and reserve maintenance, the next important action is safeguarding your possessions successfully. Guarding assets involves protecting your a knockout post wealth from potential threats such as market volatility, economic recessions, claims, and unpredicted expenditures. One reliable strategy is asset allotment, which involves spreading your investments across various asset classes to decrease risk. Diversifying your portfolio can help mitigate losses in one area by balancing it with gains in another.

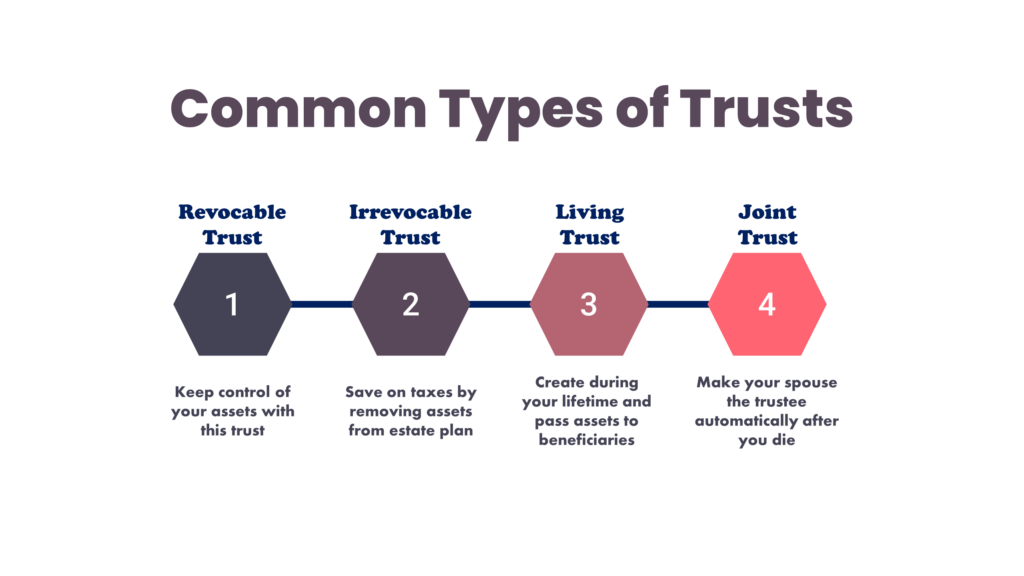

Additionally, developing a count on can supply a safe way to secure your assets for future generations. Depends on can help you manage how your possessions are dispersed, reduce inheritance tax, and safeguard your wide range from creditors. By carrying out these strategies and seeking specialist guidance, you can secure your assets efficiently and safeguard your financial future.

Long-Term Possession Defense

To ensure the enduring protection of your wealth against possible threats and uncertainties gradually, critical planning for long-term possession defense is essential. Long-term possession security entails implementing steps to protect your properties from numerous threats such as economic recessions, claims, Going Here or unforeseen life occasions. One critical aspect of long-term asset protection is establishing a count on, which can use considerable benefits in protecting your properties from financial institutions and lawful disagreements. By moving possession of possessions to a depend on, you can secure them from possible dangers while still maintaining some degree of control over their administration and distribution.

Moreover, diversifying your financial investment profile is an additional crucial technique for long-term possession protection. By spreading your financial investments throughout different property classes, industries, and geographical areas, you can decrease the impact of market variations on your overall wide range. Furthermore, routinely evaluating and updating your estate strategy is necessary to guarantee that your properties are safeguarded according to your wishes in the lengthy run. By taking a positive approach to long-lasting asset security, you can you could try these out secure your wide range and give monetary security for on your own and future generations.

Verdict

In final thought, count on foundations play an important function in securing possessions and making sure monetary safety. Professional assistance in establishing and managing trust structures is essential for lasting property defense.

Report this page